- #SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING HOW TO#

- #SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING MAC OS#

- #SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING SOFTWARE#

- #SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING PLUS#

- #SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING PROFESSIONAL#

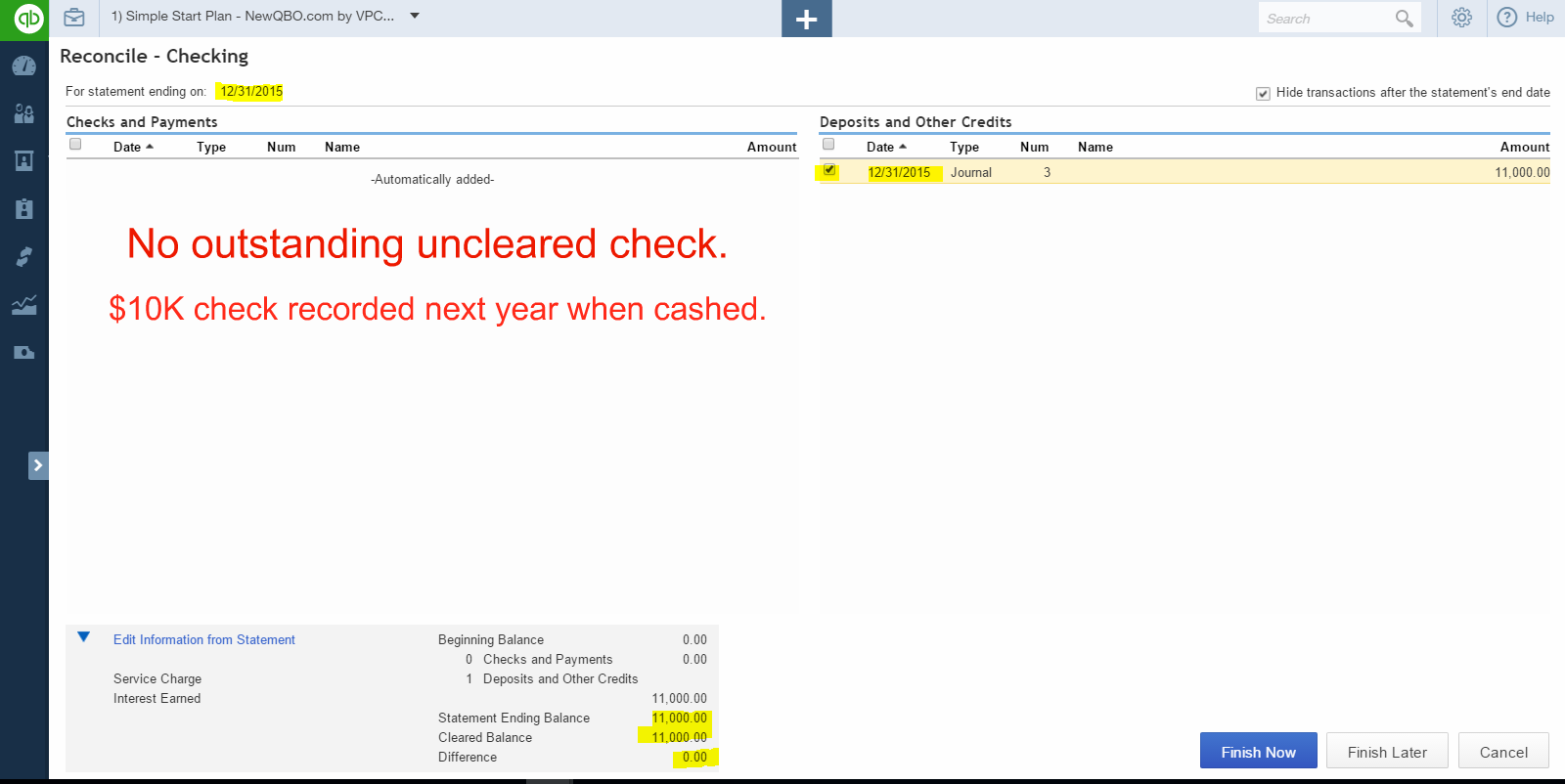

GnuCash does more than just balance your checkbook, as well. If you download GnuCash, both options are free as well. Then, once the phone company deposits your check and your bank has decreased your balance, you can record a decrease to Outstanding Checks and a decrease to your checking account.īoth options are accurate, so it’s up to you which method to use. When you write a check, record an increase to Outstanding Checks and an increase to the appropriate expense account, perhaps the telephone expense account like above. The other option is to create a liability account called “Outstanding Checks.” While the above method will be fine for most people and has the benefit of tracking the usable balance in your checking account, if you want to keep a true reconciliation, then you need an additional account. If you have outstanding checks - checks you have sent out but haven’t been cashed by the recipients - then the balance in GnuCash won’t match the balance at the bank. The problem with tracking a checking account is the reconciliation between your book of accounts (ledger) and the bank statement.

You will be able to see at a glance how much money you have truly available in the account, to help prevent overdrafts. In this manner, your checking account in GnuCash will always match your checkbook. When you write a check, you could record a decrease (GnuCash calls this a “withdrawal”) to your checking account and an increase (GnuCash calls this an “expense”) to the appropriate expense account, such as your telephone expense account. You can use the default checking account, or add more if you have more than one to track, to keep your checkbook up to date. When you create a new book of accounts (which GnuCash calls a file because the database is stored in a computer file), the default options include a checking account. GnuCash will let you easily track your checkbook. It’s a little weird at first, but it begins to make more sense as you have more practice. That means that every transaction is recorded as a transfer between two accounts.

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING SOFTWARE#

While the more popular (and more expensive) software programs use “accounts” to represent assets and liabilities and use “categories” to record expenses and income, GnuCash considers assets, liabilities, income, and expenses to all be accounts.

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING PROFESSIONAL#

Unlike Quicken and Money, the designers of GnuCash take an approach more true to professional accounting principles like double-entry accounting. Like Quicken and Money, GnuCash allows you to track your financial accounts, including cash, credit, and investments.

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING MAC OS#

GnuCash is free accounting software available for Linux and other flavors of Unix, Mac OS X, and Microsoft Windows.

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING PLUS#

If Intuit Quicken and Microsoft Money Plus are out of the question - and Nicholas’s requirement according to his email is free - then there aren’t many solutions available. For Nicholas’s purposes, these services fall short. These websites rely on downloading information from banks, and banks don’t know when you write a check unless you have sophisticated business services. Nicholas is right about Mint, Yodlee Mone圜enter, and other online services. I’d appreciate any recommendations you might have. Right now I’m using Excel, but Excel really isn’t meant to be this kind of tool. I just need to be able to keep track of everything. I don’t need something to actually connect to my bank account, although it would be convenient to be able to import transactions. Banking Deal: Earn 1.40% APY on an FDIC-insured money market account at CIT Bank. I already use, but it isn’t much good if I plan on writing a check, or if I want to create a recurring transaction. I’m trying to find some kind of free accounting software for balancing my checkbook, and that sort of thing. Pros and Cons of Universal Life Insurance.Refinancing a Mortgage And Your Credit Score.Student Loan Grace Periods Coming to an End.Best Websites For Finding Cheap Flights Online.Services You Can Get Now Online From Home.Best Home Phone Service Options by Price.4 Types of Retirement: Which Will You Choose?.

#SHOULD I BALANCE MY CHECKBOOK WITH ONLINE BANKING HOW TO#

0 kommentar(er)

0 kommentar(er)